Depreciation and Amortization Worksheet Uses

The Depreciation and Amortization Worksheet is best used to:

- Depreciate assets (other than automobiles and real estate properties) that will be reported on IRS Form 4652 Depreciation and Amortization Part III Section A & Section B from Line 19a to 19d.

- Amortize intangible assets to report on IRS Form 4562 Part VI Amortization.

What is included in the Depreciation and Amortization Worksheet?

The worksheet has 8 tabs:

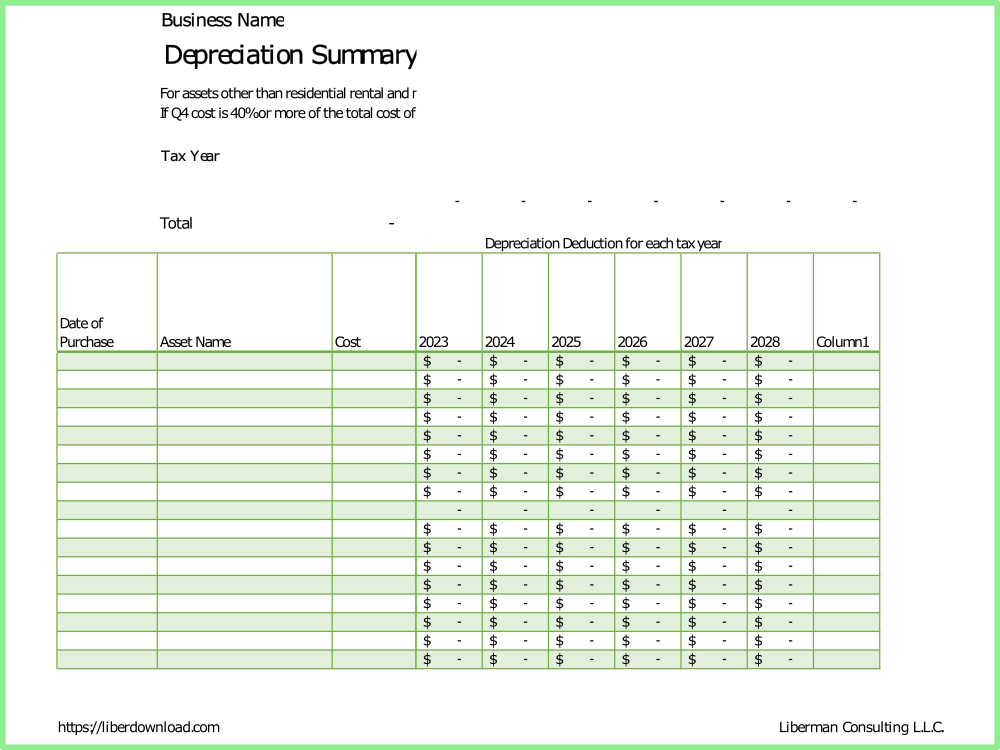

1-Depreciation Summary: where you record and depreciate assets placed in service during the year.

2-Amortization Summary: Where you record and amortize intangible assets placed in service during the year.

3-Depreciation record for assets placed in service in prior year and current year: It is used to complete IRS Form 4562 Depreciation & Amortization Part III Section A and B.

4-Amortization record for intangible assets placed in service in prior and current years. It is used to complete IRS Form 4562 Part VI Amortization.

5,6-2 Instructions tabs: where Depreciation notions are explained. They include a link to our YouTube video Playlist where you can find videos on how to depreciate business assets.

7-Tips tab: Summary of what to know to depreciate your business assets.

8- IRS Pub tab: where you can find IRS publications, instructions and forms needed to depreciate and amortize your assets and how to locate them on IRS website.

What is included in the download?

1 Excel worksheet

Materials: Digital Download Excel Workbook

Why should you use the depreciation summary spreadsheet?

You would be able to track your long-term assets together as well as the depreciation deduction claimed on them over the years for your business record.

You would be able to know when you are done claiming depreciation on any asset in your business.

How to use the depreciation spreadsheet?

When you purchased and placed assets in service, you complete the depreciation tab.

Toward the end of the year, once you are sure about quarter 4 whether you would place assets in service in the last quarter you could start completing the remaining columns of the depreciation summary sheet.

You would need Appendix A and B of IRS publication 946 “How to Depreciate Property” to find the recovery period and the depreciation rate.

Once you entered the rate, the depreciation summary spreadsheet would calculate the depreciation deduction for each recovery period. The total depreciation deduction to claim by tax year would be in the table and available.

The depreciation spreadsheet does not show you how to depreciate an asset.

To find out more about how to depreciate an asset, check our video playlist. The link is on the “instructions” tabs.

Note of Caution

This spreadsheet does not guarantee a perfect calculation of your deprecation deduction.

It is a tool to help you calculate your depreciation deduction.

It is your responsibility to know how to calculate depreciation deduction for your business assets.

Use this depreciation spreadsheet at your own discretion.

Thank you!

Reviews

There are no reviews yet.